Navigating the U.S. tax system can sometimes feel like deciphering a puzzle, especially if you’re living abroad and looking to engage in U.S. trade or business. One of the essential pieces of this puzzle is understanding the Individual Taxpayer Identification Number (ITIN). But don’t worry, I’m here to help you understand what it is, why you might need it, and how to get one. Let’s dive in!

What’s an ITIN, Anyway?

The ITIN, or Individual Taxpayer Identification Number, is like a unique code just for you. It’s a tax processing number that the U.S. Internal Revenue Service (IRS) provides. Think of it like your VIP pass into the U.S. tax world. This number is especially for those who need a U.S. taxpayer identification number but aren’t eligible for a Social Security number (SSN). So, if you don’t have an SSN and can’t get one, the ITIN is your go-to number.

Why Would You Need an ITIN?

Great question! If you’re nestled up abroad but have some cool business things happening in the U.S., then an ITIN might be on your radar. Here’s why:

1-) Personal Tax Returns: If you’re involved in U.S. trade or business, the IRS will want to hear from you at tax time, and the ITIN helps you file your tax returns.

2-) Banking in the U.S.: Dreaming of opening a U.S. bank account? The ITIN will often come in handy when dealing with American banks.

3-) Merchant Services: Planning on accepting payments for your awesome products or services in the U.S.? The ITIN can help with that!

4-) Building Credit: Yes! Even if you’re miles away, building a credit score in the U.S. can be essential for future dealings. Guess what? The ITIN can assist with that journey.

Formed a U.S. Company? Here’s Some Good News!

If you’ve taken the leap and formed a company in the U.S., first off, congrats! 🎉 Now, the cherry on top: getting an ITIN becomes a smoother ride for you and your partners. The process becomes streamlined because, in the eyes of the U.S. tax system, you’re already engaging actively within their territory.

Alright, How Do I Get One?

Securing your ITIN is a process, but it’s manageable if you know the steps:

Get the Application: Start by ordering with us, and we will evaluate your case.

Complete the Form: Fill it out, ensuring all the details are accurate. If you’re not sure about any section, it’s a good idea to consult with one of our ITIN expert on the client portal!

Submit Essential Documents: Along with your Form W-7, you’ll need to provide proof of identity and foreign status. Documents will be authenticated by our CAA.

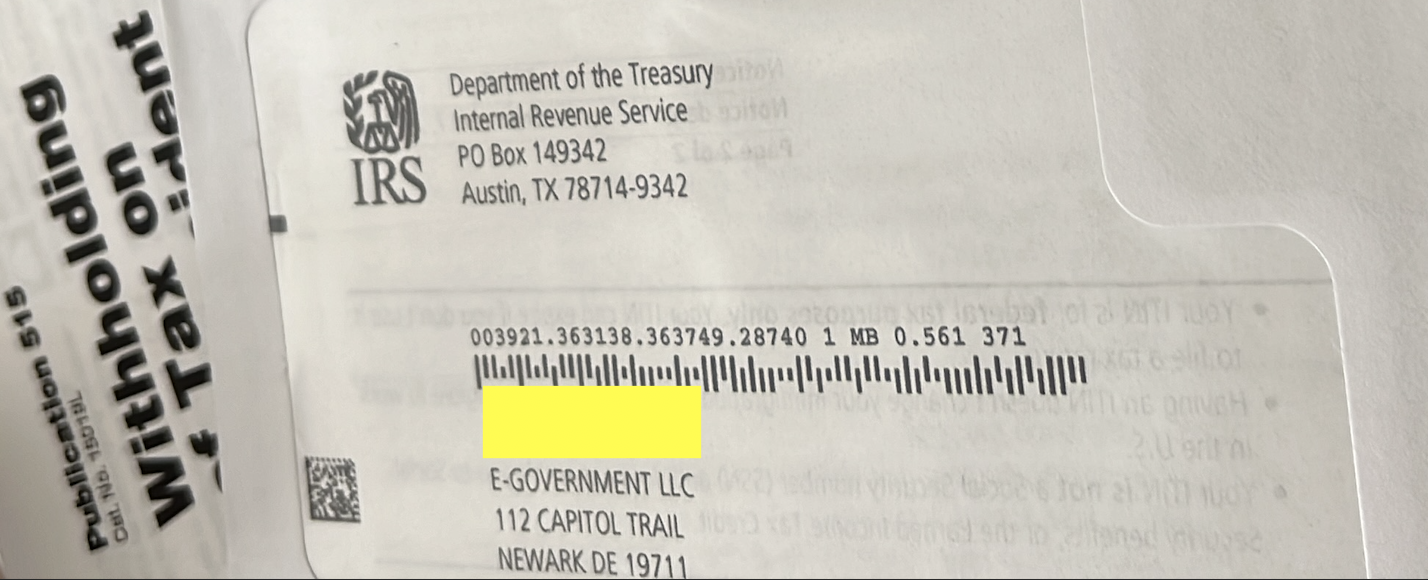

We Send The Documents the IRS: We mail everything to the IRS as your CAA.

Wait Patiently: Once everything is in, wait for the IRS to process your application. If all goes well, you’ll receive your ITIN in the portal in 8 to 14 weeks.